If dividends were not declared, closing entries would cease atthis point. If dividends are declared, to get a zero balance in theDividends account, the entry will show a credit to Dividends and adebit to Retained Earnings. As you will learn in Corporation Accounting, there are three components to thedeclaration and payment of dividends. The first part is the date ofdeclaration, which creates the obligation or liability to pay thedividend.

Salvage Value – A Complete Guide for Businesses

Since the income summary account is only a transitional account, it is also acceptable to close directly to the retained earnings account and bypass the income summary account entirely. Dividend account is credited to record the closing entry for dividends. Understanding the accounting cycle and preparing trial balancesis a practice valued internationally. The Philippines Center forEntrepreneurship and the government of the Philippines hold regularseminars going over this cycle with small business owners. They arealso transparent with their internal trial balances in several keygovernment offices.

Journalizing and Posting Closing Entries

This givesyou the balance to compare to the income statement, and allows youto double check that all income statement accounts are closed andhave correct amounts. If you put the revenues and expenses directlyinto retained earnings, you will not see that check figure. Nomatter which way you choose to close, the same final balance is inretained earnings. This means thatit is not an asset, liability, stockholders’ equity, revenue, orexpense account. Permanent accounts, such as asset, liability, and equity accounts, remain unaffected by closing entries. These accounts, including examples like cash, accounts receivable, accounts payable, and retained earnings, carry their ending balances into the next accounting period and are not reset to zero, unlike temporary accounts.

Temporary and Permanent Accounts

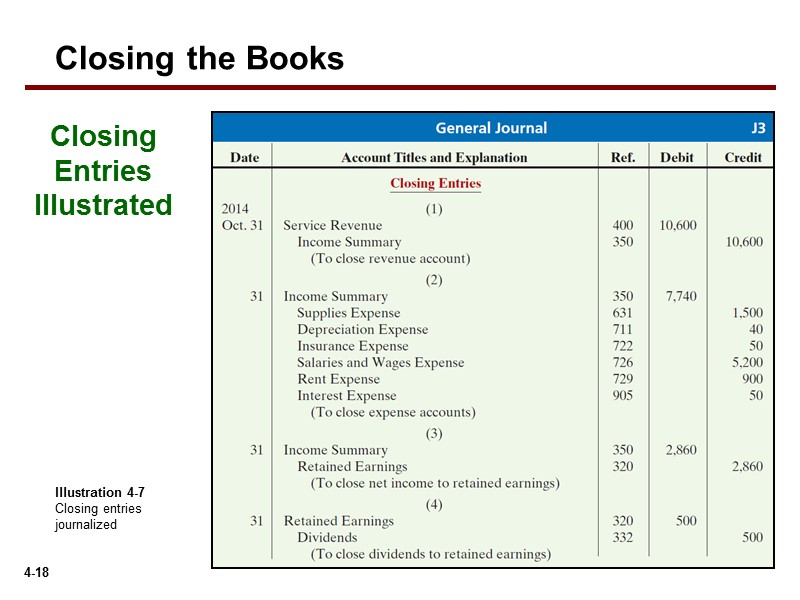

A closing entry is a journal entry made at the end of an accounting period to transfer the balances of temporary accounts (like revenues, expenses, and dividends) to the permanent accounts (like retained earnings). The accounting cycle involves several steps to manage and report financial data, starting with recording transactions and ending with preparing financial statements. These entries transfer balances from temporary accounts—such as revenues, expenses, and dividends—into permanent accounts like retained earnings. The balance in dividends, revenues and expenses would all be zero leaving only the permanent accounts for a post closing trial balance. The trial balance shows the ending balances of all asset, liability and equity accounts remaining.

To determine the income (profit orloss) from the month of January, the store needs to close theincome statement information from January 2019. Other accounting software, such as Oracle’s PeopleSoft™, post closing entries to a special accounting period that keeps them separate from all of the other entries. So, even though the process today is slightly (or completely) different than it was in the 18 best hair growth products 2021 according to dermatologists days of manual paper systems, the basic process is still important to understand. After this closing entry has been posted, each of these revenue accounts has a zero balance, whereas the Income Summary has a credit balance of $7,400. The purpose of the closing entry is to reset temporary account balances to zero on the general ledger, the record-keeping system for a company’s financial data.

- In a sole proprietorship, a drawing account is maintained to record all withdrawals made by the owner.

- We could do this, but by having the Income Summaryaccount, you get a balance for net income a second time.

- Temporary account balances can be shifted directly to the retained earnings account or an intermediate account known as the income summary account.

It’s not necessarily a process meant for the faint of heart because it involves identifying and moving numerous data from temporary to permanent accounts on the income statement. Closing entries prepare a company for the next accounting period by clearing any outstanding balances in certain accounts that should not transfer over to the next period. Closing, or clearing the balances, means returning the account to a zero balance.

He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

The Printing Plus adjusted trial balance for January 31, 2019, is presented in Figure 5.4. It is the end of the year, December 31, 2018, and you are reviewing your financials for the entire year. You see that you earned $120,000 this year in revenue and had expenses for rent, electricity, cable, internet, gas, and food that totaled $70,000. The T-account summary for Printing Plus after closing entriesare journalized is presented in Figure 5.7. Let’s explore each entry in more detail using Printing Plus’sinformation from Analyzing and Recording Transactions and The Adjustment Process as our example. The Printing Plusadjusted trial balance for January 31, 2019, is presented inFigure 5.4.

It is a holding account for revenues and expenses before they are transferred to the retained earnings account. Remember the income statement is like a moving picture of a business, reporting revenues and expenses for a period of time (usually a year). We want income statements to start every year from zero, but for accounts like equipment, debt, and cash accounts—reported on the balance sheet—we want to keep a running balance from the beginning of the business. Closing your accounting books consists of making closing entries to transfer temporary account balances into the business’ permanent accounts. The first entry requires revenue accounts close to the Income Summary account.

You can close your books, manage your accounting cycle, issue invoices, pay back vendor bills, and so much more, from any device with an internet connection, just by downloading the Deskera mobile app. Instead, as a form of distribution of a firm’s accumulated earnings, dividends are treated as a distribution of equity of the business. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

That’s exactly what we will be answering in this guide – along with the basics of properly creating closing entries for your small business accounting. The Income Summary balance is ultimately closed to the capital account. The T-account summary for Printing Plus after closing entries are journalized is presented in Figure 5.7. Let’s explore each entry in more detail using Printing Plus’s information from Analyzing and Recording Transactions and The Adjustment Process as our example.